Do you want to have a trade war...

Welcome back! Let's do a little housekeeping.

On April 1st I took a seat on the GAMA Board of Directors. I would like to thank my Team Retail colleagues for entrusing me to represent them, and all retailers, as John Coviello sails off into board retirement.

So thank you again to the voters who elected me to Team Retail, thank you to my colleagues on Team Retail for entrusting me to represent retail on the board, and thank you all for reading this, here comes the important part.

Everything you read on this website is the personal opinion of John Stephens, the author. It may not reflect the thoughts, ideas, opinions, or belief systems of GAMA, any member of the GAMA staff, or any other member of the GAMA Board of Directors. It may not reflect the opinions of Mr. Stephens family, his business partners, friends, or the government and flag he swears allegiance to.

With that out of the way, let's talk about tariffs.

This is not a Salt-N-Pepa song. (Some people will get that bad joke.)

This is not something from Frozen (because no one ever sang "Do you want to have a trade war")...

This is about some Trump taxes, a disastrous pile of isolationist, bullshit, proposals that will destroy our economy, cost tens of thousands of jobs, and alienate the allies that have, since World War II, helped us mostly maintain peace in the world.

But enough about how I feel about these tariffs, let's talk about we can deal with them. There are, in my mind, two ways of dealing with these tariffs, and I'm going to talk about each of them.

First, there is what I will call the "pass it on" method. We're going to use a generic game with a $50.00 MSRP. Publishers use a math formula to decide the MSRP of a game, and depending on the game and publisher it's somewhere between 5x and 8x. This means the MSRP is 5x to 8x the landed cost of the game. I know some people read this outside of the industry, so let's define 'landed cost' really quick, this is what it costs to make the game, and get it to your warehouse. So, a landed cost of $5.00, for a company that wants five times the landed cost as MSRP, this game would be $25.00.

If that same company wants landed cost times eight, that game would be a $40.00 MSRP. I studied journalism more than two decades ago, and I like my math simple, so here's the formula we're going to use for this study in tariffs.

MSRP - $50.00

Landed Cost - $10.00

Company Plan - MSRP = Landed Cost x5

(MASSIVE CAVEAT HERE - This is very simplified explanation of Landed Cost, and may give you the impression that landed cost never changes, but it actually changes every single time they reprint that same game; because landed costs include freight. It may cost $5,000 to get a container across the pond today, and it may cost $7,000 to move that same container in a week. It may cost $1,000 to move a container from the port to your warehouse this week, and $3,000 next week. So while printing costs may not change (or may based on materials), shipping costs are variable AF. The truth is that Landed Cost includes things you WON'T pay a tariff on, but to make the math easy, we're going to pretend that's not true.)

So today, this publisher sells the game for $50.00 It costs them $10.00 per copy to land it in their warehouse. They sell it to distribution at 40% of MSRP (this is the standard, some companies may be doing better), so they get $20.00 per copy selling to distribution, and make $10.00 per copy.

If they sell direct to retail they do it at 50% of MSRP, or $25.00 per copy. This means they make $15.00 per copy. Distribution typically buys in larger quantities than an individual retailer, so distribution gets better terms (even though I've heard that some of the orders I've placed for a title were larger than certain distributors, but that is neither here nor there).

Let's pretend, for this example, that a publisher prints 5,000 copies of this hypothetical new game. At $10.00 per landed copy, they spend $50,000 getting this game into their warehouse. They sell all 5,000 copies right away, because they're awesome (this is not always true, and adds another level of risk to the math). They sell 80% of it to distribution, making $80,000 in sales, and 20% to retailers, making another $25,000 in sales, or $105,000 in revenue on a landed cost of $50,000.

Distribution takes their 4,000 copies and sells them to retail, at the thinnest margin in the industry. They bought 4,000 copies at $20.00 each, and sold them to retail at $25.00 per copy. For their effort they got $20,000.

Retailers sell our 5,000 copies (because eventually they all ended up with us) for $50.00 each, getting $250,000 in revenue for our investment of $125,000 in this game.

So, 5,000 copies of a game land in the United States and they all sell in our above example.

Publisher makes $65,000 in gross profits from which to pay bills.

Distributor makes $20,000 in gross profits.

Retailer makes $125,000 in gross profits.

(Go ahead and wonder why retailers get the largest part of this, I'm happy to explain staffing costs, retail space costs, etc., in the future, because there is a reason for this.)

So, now tariffs come around!

The $10.00 landed cost goes to $15.40. This shipment now costs $77,000 to get into the warehouse instead of $50,000. This means instead of $65,000 in gross profits, the publisher makes $38,000 in gross profits, while distribution and retail make the same amount of money.

This is terrible and unsustainable, so the publisher decides to change the formula so landed cost times five is still MSRP. The game that used to be $50.00 is now $77.00.

Publisher sells 4,000 copies to distribution at $30.80 ($123,200).

Publisher sells 1,000 copies to retail at $38.50 ($38,500).

Publisher spends $77,000, and gets $161,000, a gross profit of $84,700.

Distribution spend $123,200, and sold their 4,000 copies for $154,000. They have a gross profit on our fictional product of $30.80.

Retailers sell all 5,000 copies at $385,000, after spending $192,500 on them, so we make $192,500 in gross profits.

Publishers made $19,700 more.

Distributors made $10,800 more.

Retailers made $67,500 more.

(This is magical Christmas land, because if a $50.00 game goes to $77.00 overnight, no one is selling all 5,000 copies in that print run anymore.)

Consumers PAID $135,000 more, and every tier of the industry made greater profits on these tariffs.

I stand in opposition to this plan.

So here is a second plan.

The $50.00 games goes to $56.00. Distribution agrees to buy it for $15.40, paying the tariff back to the publisher. Retailers agree to buy it for $30.40, paying the tariff back to the distributor or the publisher, whoever we bought it from.

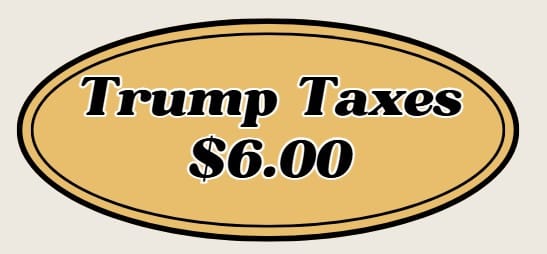

Retailers sell the formerly $50.00 game at $56.00, with a giant sticker that says "Trump Taxes $6.00."

Here's the truth. We could all agree to eat these tariffs equally, and just make less money at every step. We could dramatically raise the MSRP of games, but people will just stop buying them, or we can work together to pass these fees directly to the consumer and not make or lose money on them.

I'm a fan of passing them through transparently because consumers need to understand this. That's a form of activism, a clear and concise price change with a clear and concise communication of why it exists. Maybe we can get people to understand how elections matter...

On that note. I have decided that this blog will be posted at 8:00 AM Eastern time on Friday mornings for the foreseeable future. It is late today, because I wanted to write about tariffs instead of the post I wrote earlier in the week. That post will arrive next Friday at 8:00 AM Eastern. If you'd like to be notified of new posts on this blog you can sign up for free, and with that same free signup, you can leave comments here and tell me I'm stupid.

Happy weekend!